30 30 30 10 Budget Rule: A Simple Way to Spend and Save

This post may contain affiliate links, which means I may earn a small commission if you click and make a purchase. You can read our full disclosure policy here.

Last Updated on July 1, 2023 by Rebecca

Tired of struggling to keep up with monthly expenses? Ready to put a little something into savings? The 30 30 30 10 budget can help you get closer to your financial goals.

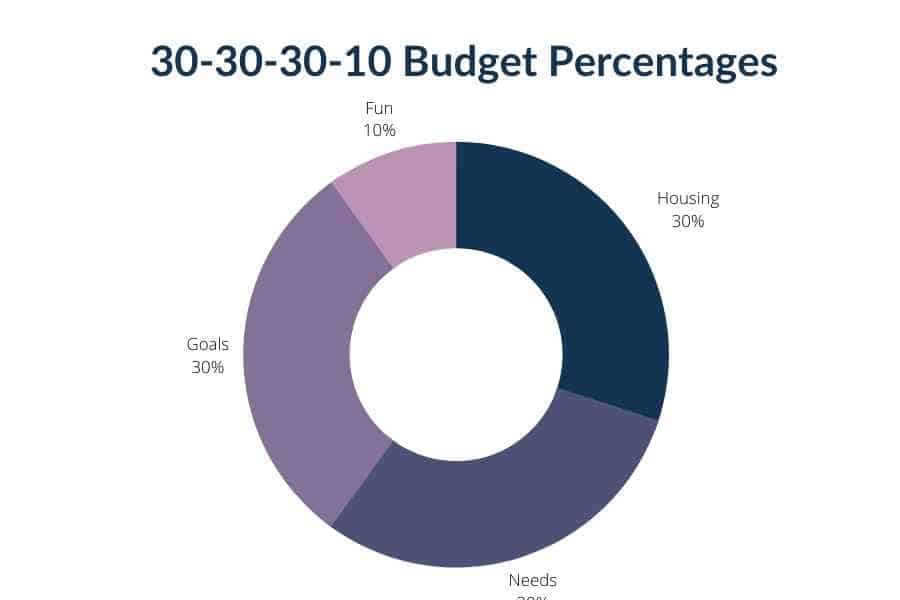

A 30-30-30-10 budget system divides your monthly income based on percentages. Using your after-tax income, you’d divide your money up like this:

- 30% to housing costs

- 30% to necessities, such as food and utility bills

- 30% to financial goals, such as paying debts or adding cash to your emergency fund

- 10% to wants or “fun”

You might consider the 30 30 30 10 budgeting rule if you’re ready to step up your savings or get serious about debt repayment.

But is it the right budgeting method for you? Understanding how this budgeting system works can help you decide.

Want free money?

Check out my favorite apps for making extra money and earning cash back!

Survey Junkie. Earn up to $50 per survey for sharing your opinions

Swagbucks. Make money playing games and watching videos ($5 bonus!)

InboxDollars. Take surveys and get paid for your opinions

Rakuten. Earn up to 40% cash back, plus get $30 for each person you refer

CashApp. Get $5 free when you use code ‘VZXRXZN’ to join CashApp

Writers Work. Earn extra cash from your writing skills!

What Is the 30/30/30/10 Budget Rule?

The 30 30 30 10 budget is a percentage-based budgeting method that divides your monthly take-home pay into four spending categories. Each figure represents the percentage of your money that’s meant to go toward each category.

- Housing: 30% of net income goes toward housing expenses like rent, mortgage, property taxes, and maintenance

- Needs: 30% of income is the needs category and it covers basic necessities like bills, groceries, and transportation

- Goals: 30% of your salary goes toward your goals, which may include saving, investing or debt repayment

- Wants: 10% of your budget is dedicated to non-essential expenses, like Netflix or gym memberships

Pro tip: The 30/30/30/10 budget uses your post-tax income to calculate the percentages, not your gross income.

Who Is the 30 30 30 10 Budget Right For?

The 30 30 30 10 rule budget could be a good choice for anyone who wants to prioritize debt repayment or saving while limiting how much they spend on unnecessary expenses. You may also consider a 30 30 30 10 budget plan if you prefer to budget separately for housing and basic living expenses, or if you’ve tried and failed at using other systems, like the 70 20 10 budget or 80/20 budgeting.

A 30 30 30 10 budget system could work for people who:

- Have tried traditional budgeting methods but have found them hard to stick to

- Would rather budget using broad categories vs. narrow ones

- Want an easy way to divide household income each month

- Are working on savings goals that require discipline and time to achieve

- Have multiple debts to budget for, such as credit cards, car payments or student loans

Now, who is a 30-30-30-10 budget not a good fit for?

This budgeting method may not work as well if your mortgage payment or rent payment is more than 30% of your take-home pay.

That could happen if you live in an area with a high cost of living like San Francisco or New York. And you might spend more of your money on housing if you earn a below-average income.

It could also be a mismatch for people who want to dedicate more of their disposable income to discretionary spending or “fun money”.

Grow your money faster! Want to get a great rate on your savings? Open a high-yield savings account to earn the most competitive APY on deposits.

How to Make a Budget Using the 30 30 30 10 Rule

Implementing a 30 30 30 10 budget isn’t that difficult. The basic steps are similar to making any other type of budget.

Here’s how it works:

- Add up your monthly income

- Add up your expenses

- Set your financial goals

- Divide your expenses into the four main categories

- Calculate how much of your income goes to each category

Within the main categories, you might have different categories for individual expenses. The number of budget categories you include is up to you and it depends on how you typically spend.

Related post: How to Make a Budget Step by Step

30 30 30 10 Budget Categories

As mentioned, there are four main categories that you’ll put money into each month with a 30-30-30-10 budget.

Here’s a closer look at how they work.

30% for housing

The 30 30 30 10 budget dictates spending 30% of your income on housing each month. That includes:

- Mortgage or rent payments

- Homeowners or renter’s insurance

- HOA fees

- Appliances

- Transportation

You might include property taxes and HOA fees here as well if you own a home and those expenses aren’t rolled into your mortgage payment.

So, is this realistic?

The 30% rule–which says you should spend no more than 30% of your income on

housing–dates back to the 1960s.

Whether 30% of your income for housing is a good number can depend on where you live and how much you make. As rent prices rise, more households are becoming rent cost-burdened, meaning they spend more than 30% of their income on rent.

But if you can stick with 30% or less for housing, that leaves you with 70% of your income for other expenses.

30% for necessary expenses

The next part of the 30-30-30-10 budget covers basic needs other than housing.

Here are some of the budget categories that would go here:

- Utilities

- Groceries and food at home

- Internet and phone service

- Essential clothing

- Health insurance and health care

- Childcare

- School-related expenses

- Pet care expenses

- Kids toys

This budget percentage covers the things you need to pay to maintain a basic standard of living. In other words, these are your “needs”.

30% for financial goals

Setting goals for your money matters. And you probably have at least a few financial goals you’re working toward.

The next part of the 30 30 30 10 budget involves budgeting for your goals. So those might include:

- Paying off credit card debt

- Increasing debt payments to student loans or your mortgage

- Building an emergency savings account for unexpected expenses

- Saving and investing money for retirement

- Setting aside money for your kids to pay for college

- Creating a vacation or new furniture fund

- Saving money for home repairs or renovations

- Starting a business or side hustle

By putting savings, debt repayment and other goals into one bucket you can prioritize both. That’s a plus if you struggle with the question of whether to save or pay down debt first when trying to reach your money goals.

Ready to start saving? Try the 100 Envelope Savings Challenge and discover that saving money is easier than you think!

10% for wants/fun

The last part of the 30-30-30-10 budget earmarks 10% of your income for wants or “fun” spending.

So you can use this part of your budget for things like:

- Streaming subscriptions

- Dinner out

- Entertainment

- Books (my personal favorite splurge!)

- Nonessential clothing

- Toys for the kids

- Vacations or travel

In other words, these are things you don’t need to spend money on to live. But they’re the “nice to haves” in your budget that keep you from feeling like all your money goes to bills and debt.

Pro tip: Struggling to stay on top of expenses? Consider using a personal finance tool like Empower to track all of your financial accounts in one place.

30-30-30-10 Budget Example

Seeing an example of the 30 30 30 10 budget in action can be a good way to gauge whether it’s right for you.

Let’s assume you bring home $5,000 a month in after-tax income. If you’re following the 30/30/30/10 budget rule, here’s how you’d divide it up:

- $1500 for housing (30%)

- $1500 for needs (30%)

- $1500 for goals (30%)

- $500 for fun (10%)

This type of budget allows for some flexibility since you can decide the best way to spend the money that you’ve allotted for each category.

For example, say you have two goals: paying off $5,000 in credit card debt and saving $10,000 for a new car.

You might decide to set aside $500 in a bank account for car savings and use the remaining $1,000 in your goals category to make extra payments to your credit cards above the minimum payments due.

Or you might use the money to accelerate loan repayments if you have student debt or a mortgage. For example, you could switch to biweekly payments, which would allow you to make one extra monthly payment each year.

When the new budget period begins, you might decide to switch things up and dedicate more money to savings and less to debt.

With other budget systems, like zero-based budgeting, you have to be more precise about where each dollar in your budget goes. A 30 30 30 10 budget could be a better fit for your financial situation if your spending habits aren’t the same month to month.

Pro tip: Budgeting isn’t just for teens and families. Even younger kids can try making a needs/want budget of their own to learn basic money skills!

How to Make a 30-30-30-10 Budget

If you want to put the 30 30 30 10 budget to work, don’t stress!

Here’s how to create a budget using this personal finance rule of thumb.

1. Add up your income

The first step in making a 30 30 30 10 budget is knowing how much income you’re working with. Your monthly income includes all of the money you bring each month and can include:

- Paychecks earned at a 9 to 5 job

- Money from a part-time job

- Side hustle income

- Business income

- Social Security if you receive disability benefits or survivors’ benefits

- Interest income

- Investment income

The easiest way to find your take-home pay after taxes is to check your pay stubs. It should be listed as net pay and you can also review deductions for taxes, health insurance and retirement plan contributions.

If you don’t have pay stubs handy, you can also check your bank statements if you get paid by direct deposit.

And if your paychecks are irregular because you freelance or do contract work, there’s a simple solution. Add up all of your annual income for the past year and divide it by 12 to find your monthly average.

2. Add up essential expenses

Once you know how much money you have to budget, you can add up your expenses.

For now, focus just on your essential expenses. In terms of specific categories, that means:

- Housing and related costs

- Utilities

- Groceries and food

- Insurance

- Clothing

- Childcare

Include each individual expense you need to pay each month to maintain your household. Leave out the wants or extras, though, since you’ll budget for those later.

3. Set your financial goals

Next, think about what your goals are for your money. For this part of making a 30-30-30-10 rule budget, it helps to be as specific as possible.

So instead of saying I want to send extra money to my credit card, you might say something like, I want to pay $200 a month to my card so it’s paid off in 10 months.

The same goes for savings.

So rather than setting a vague goal of adding to your emergency fund, you might set a goal of saving $100 a month.

The more specific you can be the better. This can help you decide what to do with your money in step 4.

4. Divide your income

If you have your income, expenses and goals ready, then you can divide up your income into each budget category.

So again, let’s say you make $5000 a month. You know you have $1,500 for housing, $1,500 for needs, $1,500 for goals and $500 for wants.

You can decide how to spend each amount of money. But what if your expenses are more than what you have to spend in one category?

First, you could look at your needs category to see what expenses you might be able to lower.

If you need some help with that, using an app like Trim is a great way to approach it. Trim helps you find wasted money in your budget so you can cut those expenses out.

Another option is taking money away from another category to put toward essentials. So, you might have to cut back on wants or goals.

A third option is to find ways to make more money.

You could do that by asking for a raise at work or getting a part-time job. Or you could explore ways to make extra money from home.

5. Fine-tune your budget

Once you’ve made your budget you can’t just set it and forget it.

It’s a good idea to do a monthly budget review to see how much you’re spending, whether you’re going over in any of your budget categories and where you might need to shift spending or saving to reach your goals.

This isn’t a hard and fast rule but it’s something financial experts often recommend. And if you’re trying to teach your kids the importance of budgeting, a monthly family money meeting can be a great way to do it.

Ready to get your budget together?

Grab our monthly budget worksheet, spending tracker and debt repayment tracker when you join the Savvy Money Lessons email list!

30 30 30 10 Budget vs. 50 20 30 Budget

The 50-30-20 budget is arguably one of the most popular ways to budget by percentages.

Developed by US Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, authors of All Your Worth: The Ultimate Lifetime Money Plan, this budget rule suggests budgeting:

- 50% of your income for needs

- 30% of your income for wants

- 20% of your income for savings

Essentially, you’re spending 80% of what you make with this budget method and saving 20%.

The 50% for needs can include things like housing, food, utilities and debt repayment. The 30% for wants can include “fun” spending and anything that’s not considered essential.

The rest goes to savings. Super simple, which may be a good thing if you don’t want to spend a lot of time trying to make a family budget.

You won’t save as much with this budget rule as you would with 30-30-30-10 budgeting. But you may consider it if you don’t have debts to repay and you’re comfortable saving 20% of what you make.

Recommended Books About Budgeting & Money

Money doesn’t have to be a mystery. If you’re ready to get your budget together and start growing wealth, check out these top personal finance books!

Final thoughts on 30/30/30/10 budgeting

The 30 30 30 10 budget rule could work for you if you want a budget method that allows you to pay your bills and still have a life (without feeling guilty about it). You can use it with the cash envelope system or a budgeting app like Mint.

And remember, it’s not difficult to try a 30-30-30-10 budget, even if you’ve never budgeted by percentages before.

If you’re ready to make a realistic financial plan for your family, the 30 30 30 10 budget could be a good place to start. You can also explore other options, like the 10 10 80 budget method.

Have you tried the 30 30 30 10 budget rule?

About the Author

Rebecca is a certified educator in personal finance (CEPF) and a money-saving expert. As a single mom of two teens, she knows all about the importance of family budgeting and financial goal-setting. She shares her best tips about saving and managing money at Savvy Money Lessons. You can also read her work online at Bankrate, Forbes Advisor, Investopedia and other top publications. Learn more

![70 20 10 Budget Rule [How 70-20-10 Budgeting Works]](https://savvymoneylessons.com/wp-content/uploads/2023/06/30-30-30-10-Budget-2-640x1024.png)

![Financial Planning for Families Checklist [2023]](https://savvymoneylessons.com/wp-content/uploads/2023/03/Important-Lessons-to-Teach-Kids-About-Money-640x1024.jpg)

![100 Envelope Challenge Chart [Free Printable Savings Tracker!]](https://savvymoneylessons.com/wp-content/uploads/2022/04/Savvy-Money-Lessons-Pins-640x1024.jpg)

![Gardening to Save Money [8 Smart Tips to Cut Your Food Budget!]](https://savvymoneylessons.com/wp-content/uploads/2021/06/Gardening-Tips-to-Save-Money-640x1024.jpg)

5 Comments